Private equity – participations in unlisted companies

Many are only familiar with investments in company participations in the form of shares – public equity – that are traded on public security exchanges. Yet there is another, similarly large market, which tends to remain hidden for the majority of private investors: private equity. This refers to shareholdings in companies that are not listed on any stock exchange, which are usually made possible in the form of private equity funds.

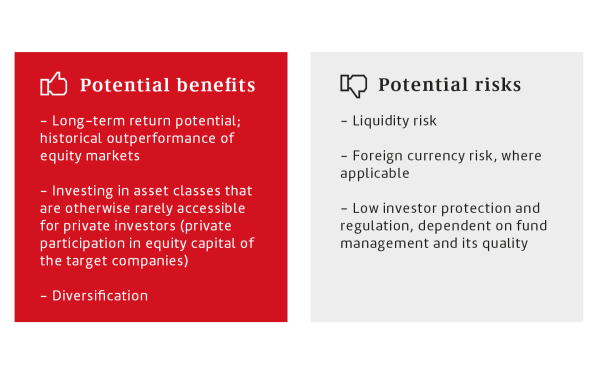

Private equity – the benefits and risks

For investors as well as for companies, private equity can offer considerable advantages compared to publicly traded securities. On the one hand, one is largely spared the uncertainties and often irrational price movements on public markets, and on the other, in the past, private equity investments were partly able to achieve significantly higher returns than listed shares. Since private equity funds invest in multiple companies operating across various regions and a range of different industries, this also produces a broad distribution of risk. However, it is also important to keep the potential risks in mind and take a holistic approach to find the right allocation for this special asset class.

Why is the return on private equity potentially higher than for listed shares?

Entry

Access to non-public information as part of the auditing of the investment (due diligence)

The information advantage obtained minimises investment risks

Optimisation

Improvements in ongoing operations (efficiency improvements, economies of scale, cost reductions, financing costs, ...)

Acquisitions of companies and parts of companies

Structure optimisations

Exit

Exit in the course of flotation

Sale to strategic investor or financial investor

Private Equity – due diligence

In the course of the extensive auditing of non-public information (due diligence) before an investment, a considerable information head-start can be obtained, which helps to minimise investment risks even when making a decision about an investment.

Private equity - value creation

During the phase in which a private equity fund has a shareholding, an attempt is made to improve the economic success of the associated company using various levers. The fund managers work in a very targeted manner to achieve improvements in the ongoing operations (such as efficiency improvements, achieving economies of scale, cost reductions, optimisation of the financing costs). In many cases, companies or parts of companies are also very actively acquired in order to supplement the existing company (buy and build strategy). In addition, the structure is often optimised so as to meet the organisational needs of the new improvements.

Private equity - exit

In many cases, an additional increase in value can also be obtained during the exit from the investment by means of a resale to strategic or financial investors or flotation.

The challenges

Access and selection

Access to the top managers

Due diligence

Diversification

Lack of diversification due to high minimum investment of 5 million euros per fund

J-Curve

The so-called J-curve can be optimised by adding secondary funds

Negotiating power

Legal contractual basis and conditions may require renegotiation in part, if they are not in conformity with market requirements

Administration

Cash flow management

Ongoing monitoring and maintenance

Investing in private equity comes with its own set of challenges. One of the obstacles for private investors tends to be the minimum investment amount, which is frequently at least 5 million euros. Extensive know-how and a professional due diligence process are just as essential as ongoing systematic market observation and careful administration of the flow of capital.

“The risk of a total loss of the invested capital or the capital beyond this is counteracted by distribution and thus reduced, but cannot be completely excluded by definition.”

Linked notes are not traded on any regulated markets, making their tradeability very limited.

Private Equity - expertise by Schelhammer Capital

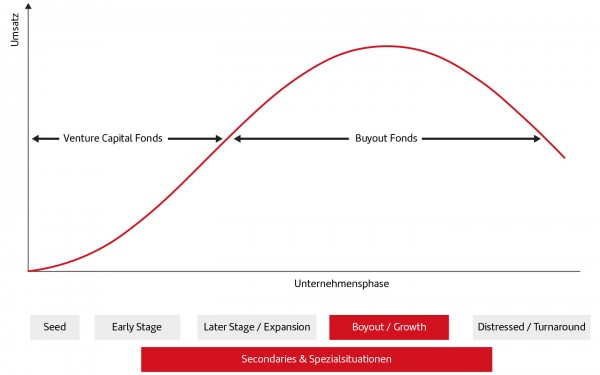

We have built up our know-how in the area of private equity over more than 15 years, whereby we focus on the segments of buyouts, growth as well as secondaries and special situations.

Private equity linked notes

Schelhammer Capital offers you the possibility of participating in the performance of mezzanine and private equity funds from an investment amount of just €150,000 via linked notes. This enables a considerable reduction of the required minimum investment and a distribution of the allocation among multiple funds and fund managers and their management styles.

Legal information:

This is an advertising message by Schelhammer Capital Bank AG.

The basic fact sheet created and published for the linked notes issued by GBG Private Markets GmbH pursuant to Art. 5 EU Regulation No. 1286/2014 (PRIIPs regulation) may be obtained at the headquarters of the issuer at 8010 Graz, Burgring 16 and is available for download on its website www.privatemarkets.at. The offer is public in Austria; however, it is released without a prospectus due to the minimum investment of EUR 150,000 (first access).

Further documents, information and the terms of issue are available from the advisors at Schelhammer Capital.

This information was prepared for informational purposes only. It was not prepared in compliance with the legislation designed to promote the independence of financial analyses and is not subject to the prohibition on trade following the publication of financial analyses (Art. 36 EU Regulation 2017/565). This document does not constitute a financial analysis, investment recommendation or investment advice. It contains neither an offer to conclude a contract for investment services or ancillary services, nor a request to make an offer to conclude a contract for investment services or ancillary services. If this communication refers to products that are subject to the obligation to provide a prospectus according to the capital market regulations, under no circumstances does this information replace the prospectus published by the respective issuers. All capital investments are associated with risks. It is possible that it may lead to a total loss of the capital invested; in addition to this, with private equity investments, additional contribution obligations may be incurred on the invested capital. Since not all transactions are suitable for all investors, investors should consult their own advisors before concluding a contract (in particular legal and tax advisors). The purchase of shares in alternative investment funds of GBG Private Markets GmbH requires the capacity of qualified private client (pursuant to § 2 (1) Clause 42 Directive on Alternative Investment Fund Managers).